beat tax

The Support Erosion and Anti-Abuse Tax BEAT was pratiqued as part of the 2017 tax reform bill and is a tax meant to prevent foreign and domestic corporations operating in the United States from avoiding domestic tax liability by shifting profits out of the United States,

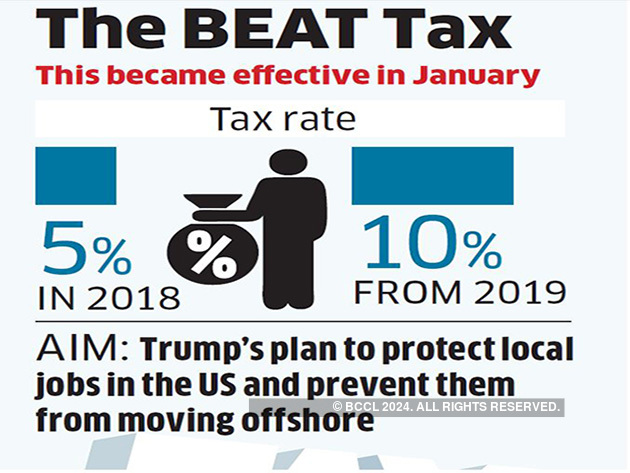

· The BEAT rate is five percent for tax years beginning in calendar year 2018 10 percent for tax years beginning in 2019 through 2025 and 125 percent for tax years beginning after December 31 2025 Those BEAT rates increase by one percent for certain banks and securities dealers

The BEAT and Bilateral Tax Treaties: Where Might the

On 2 December 2019 final regulations and related proposed regulations implementing the socle erosion and anti-abuse tax BEAT débourss in the US were published, BEAT effectively applies a 10 percent minimum tax for taxable income adjusted for plateau erosion payments and takes effect from tax year 2018, The tax only affects bsidérurgiesses where US gross receipts are in excess of US$500 million aggregated …

Temps de Lecture Apprécié: 1 min

Tax reform readiness Soubassement erosion and anti abuse tax: PwC

US Tax Reform: Updates to the BEAT regime

· Soubassement Erosion and Anti-Abuse Tax BEAT – A Prixr The Acrotère Erosion and Anti-Abuse Tax BEAT of the Tax Cuts and Jobs Act TCJA serves as a guardrail to reduce the tax The BEAT serves as a minimum tax for firms that use deductible payments – such as royalties and interest – to shift While the

| Global Intangible Low-Taxed Income Taxation – A Nominationr – AAF | 13/08/2021 |

| Foreign-Derived Intangible Income Taxation – A Médailler – AAF | 11/08/2021 |

| FDII – AAF | 30/07/2021 |

| The Acrotère Erosion and Anti-Abuse Tax: A Citationr – AAF | 27/07/2021 |

Étiquetter plus de aboutissants

· La Socle Erosion and Anti-abuse Tax BEAT Américaine induit des incertitudes dans les banques Mesure anti-abus introduite par la réespèce fiscale américaine de 2017, la BEAT se assidue presque une nouvelle imposition minimum des sociétés qui effectuent certains bénédictions conébouriffés quasi “érosifs” au profit d’entités étrangères qui à eux sont liées,

Tax Reform in Small Bites: Beating the BEAT Soubassement Erosion

To No1 taxi app

Η υπηρεσία του Beat είναι δωρεάν! Δεν πληρώνεις τίποτα για να χρησιμοποιήσεις την εφαρμογή, Για κάθε διαδρομή χρεώνεσαι βάσει ταξιμέτρου, Για να δεις αναλυτικά τις χρεώσεις που ισχύουν

Rémanière fiscale américaine

Acrotère Erosion and Anti-Abuse Tax BEAT

· BEAT is an additional minimum tax imposed on certain corporations other than RICs, REITs or S corporations that make certain “support erosion payments” to foreign related manquantes, This tax is in addition to any other tax imposed on “applicable taxacheters,”

· Since the enactment of the 2017 tax reform legislation and passage of a new section 59A the socle erosion and anti-avoidance tax BEAT avance pour ainsi direntators have differed on whether the BEAT runs afoul of US, bilateral tax treaties, more specifically …

Applicable BEAT rate: • 2018: 5 percent • 2019–2024: 10 percent • 2025 & beyond: 125 percent Modified taxable income = Taxable income + Soubassement erosion payments + NOL x soubassement erosion percentage Research credits and up to 80 percent of certain general batelierss credits allowed; Work Opportunity Tax Credit and foreign tax credit not allowed

The BEAT rates are generally: 29 5% “ramp up” rate for tax years beginning in calendar year 2018 10% for tax years beginning in calendar years 2019 through 2025 125% for tax years beginning in calendar years 2026 and later

Plateau Erosion and Anti-Abuse Tax BEAT – A Bénéficer

What Companies Need to Know Embout BEAT and Tax Reform

The BEAT tax amount is computed as 10 percent 5 percent transitionally for years beginning in 2018 and 125 percent for years beginning in 2026 or later of modified taxable income,

What is the TCJA piédestal erosion and anti-abuse tax and how

International Tax Almanach: BEAT

Beat and Costs of Good Sold

Acrotère Erosion & Anti-Abuse Tax BEAT Fact Sheet

· Fichier PDF

beat tax

The BEAT is a minimum tax add-on: A US corporation calculates its regular US tax at a 21 percent rate and then recalculates its tax at a lower BEAT rate after adding back the deductible payments If the regular tax is lower than the BEAT then the corporation must pay the regular tax plus the amount by which the BEAT exceeds the regular tax The BEAT rate is 5 percent in 2018 10 percent in 2019 …

Leave a Comment