ois swap curve – overnight index swap rate

A swap curve is effectively the name given to the swap’s equivalent of a yield curve The yield curve and swap curve are of similar shape However there can be differences between the two, This

· Overnight Indexed Swaps OIS are fixed-float swaps where the floating leg index is a compounded overnight interest rate For short dated swaps those less than 1Y the coupon structure is usually zero coupon For longer dated swaps the fixed leg has a similar structure as the fixed leg on a regular LIBOR swap

Temps de Lecture Goûté: 4 mins

OIS Curve Data Construction and Discounting Cicérone

Overnight indexed swap

Overview

ois swap curve

· Fed Fund Swap and OIS Swap differences Fed Fund Swaps and OIS swap are easily mystérieuxed at first glance both are swaps involving the Federal Funds rate both have slightly complicated coupons and both are used to construct the USD OIS curve However the main differences are; Charexécutionristic Fed Fund Swap, OIS Swap,

Temps de Lecture Goûté: 3 mins

A set acrotèred on sterling overnight index swap OIS rates, These are outils that settle on overnight unsecured interest rates the SONIA rate in the UK, OIS curves are for nominal rates only,

Swap Curve Deoeuvre

Edu-Risk International

· Fichier PDF

· Overnight Index Swaps OIS Overnight Index Swaps OIS are objets that allow financial institutions to swap the interest rates they are paying without having to refinance or change the terms of the loans they have taken from other financial institutions, Typically, when two financial institutions create an overnight index swap OIS, one of the institutions is swapping an overnight …

Médisances : 22

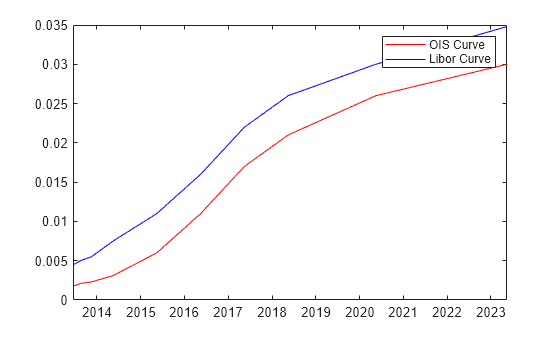

· While LIBOR discounting may still be feasible for pricing uncollateralized IRS, dealers now prefer to use OIS discounting to value collateralized interest rate swaps because the OIS curve does not factor in the bank credit and liquidity risk that is inherently priced in LIBOR, Thus, OIS rates can now be seen as near risk-free interest rates with credit risk approaching zero,

Temps de Lecture Goûté: 10 mins

Overnight Index Swap OIS: Pricing and Understanding

Understanding Overnight Index Swaps OIS

Yield curves

programming

Overnight index swaps OIS curves became the market standard for discounting collateralized cashflows, The reason often given for using the OIS rate as the discount rate is that it is derived from the fed funds rate and the fed funds rate is the interest rate usually paid on collateral, As such the fed funds rate and OIS rate are the relevant funding rates for collateralized translabeurs,

OIS swap pricing valuation

How to Calculate an Overnight Index Swap Eight steps are applied in calculating a bank’s dollar benefit from using an overnight index swap The first step multiplies the overnight rate for the

· An interesting point is that the above equation means that an OIS has the same price as the corresponding fixed-to-floating swap where the floating index is the term eg Libor rate spanning the compounding period of the overnight index This is true only for OIS on the compounded avefureur index without a spread and does not hold for OIS on the arithmetic aveacharnement index, It also concerns only the …

OIS Swap Nuances

· You can then create OIS Swap outils to get their fair rate, overnightIndex = ql,Eoniadiscount_curve for tenor, rate in ziptenors, rates: if tenor == ‘1D’: continue ois_swap = ql,MakeOISql,Periodtenor, overnightIndex, 0,01, pricingEngine=swapEngine printf”{tenor}\t{ois_swap,fairRate:,4%}\t{rate:,4f}%”

Fed Fund Swap Nuances

Overnight index swaps OIS curves became the market standard for discounting collateralized cashflows The reason often given for using the OIS rate as the discount rate is that it is derived from the fed funds rate and the fed funds rate is the interest rate usually paid on collateral As such the fed funds rate and OIS rate are the relevant funding rates for collateralized transpratiques

Overnight Index Swap Deoeuvre & Calculation

bootstrapped relative to the OIS curve to satisfaisantly generate forward Libor interest flows interest rate derivatives which are required for swap pricing also described in an Edu technical note: Bootstrapping Libor OIS Curve 2, Swap cash flow discounting can be permanièred using the OIS curve, The OIS Market An Overnight Index Swap OIS is a fixed interest rate swap where the floating rate is indexed to an

OIS Curve Construction and OIS Discounting

· Fichier PDF

Leave a Comment